Budget 2023 speech was made by the finance minister on 2nd of February 2023, which has announced few changes for the taxpayers for the upcoming financial year April 2023 to March. Key highlights of announcements impacting individual tax payers is provided below:

- No changes in old tax regime therefore no incentives as well, this budget gives a hint on government’s intention to lure people towards the new tax regime announced a couple of years back. We can see that, in few years down the line, deductions based tax filing will be done away with.

- Capital gains on sale of all listed securities in India mentioned below (other than debt oriented mutual funds or MFs) held for over 12 months are treated as LTCG.

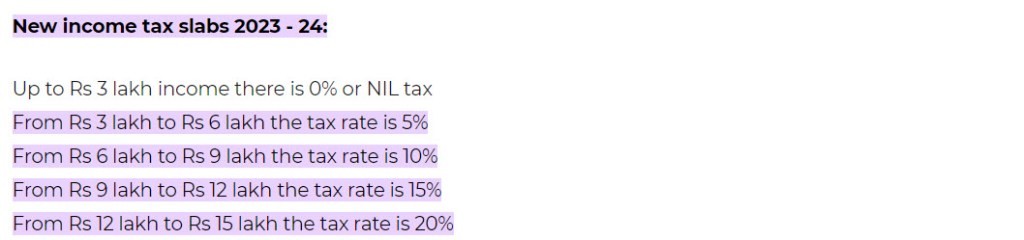

- The new income-tax regime has been made more lucrative. Under this, those with income up to 7 lakh a year need not pay tax.