The thin line between being an “exporter of services” and an “intermediary” has long been a source of friction between Indian businesses and tax authorities. For many wholly owned subsidiaries of foreign companies, this distinction is not just semantic—it is a million-dollar question involving the eligibility for Goods and Services Tax (GST) refunds.

A recent judgment by the Gujarat High Court in the case of Infodesk India (P.) Ltd. v. Union of India provides much-needed clarity on this “intermediary” tag and reaffirms the rights of service providers working on a principal-to-principal basis.

The Conflict: Service Provider or Middleman?

Infodesk India is a wholly owned subsidiary of a US-based entity, established to provide technical services, software consultancy, and IT infrastructure management exclusively for its parent company. The company operated methodically: the parent company raised requirements through “JIRA tickets” (a service desk platform), and Infodesk India’s employees fulfilled these tasks.

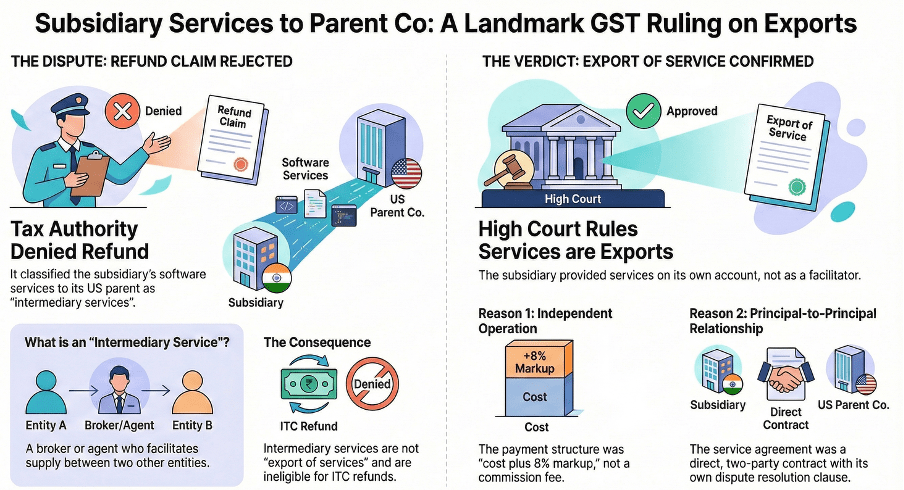

When Infodesk India applied for a refund of unutilized Input Tax Credit (ITC) on its zero-rated supplies (exports), the tax authorities rejected the claim. Their reasoning? They classified the company’s software consultancy as an “intermediary service” under Section 2(13) of the IGST Act, rather than an “export of service” under Section 2(6).

In the eyes of the authorities, Infodesk was merely a broker facilitating services between the parent company and its global clients.

The Court’s Deep Dive: What Makes an Intermediary?

To resolve the dispute, the High Court scrutinized the Service Agreement and the nature of the operations. Under Section 2(13) of the IGST Act, an intermediary is defined as a broker or agent who arranges or facilitates the supply of goods or services between two or more persons. Crucially, this definition excludes anyone who supplies such services on their own account.

The Court highlighted several factors that proved Infodesk India was an independent exporter, not a middleman:

• Principal-to-Principal Basis: The agreement was bipartite (between two parties) rather than tripartite. Infodesk was providing services directly to its parent company on its own account.

• Independent Capacity: As an independent company incorporated in India, Infodesk was a distinct entity providing services in an independent capacity, not as a broker or agent.

• The Profit Model: Infodesk received a fee equal to the cost plus an 8% markup. It bore all its own expenses, including taxes and salaries, further proving it was not acting as a mere conduit.

• Nature of Work: The company provided specialized services—editorial content, IT management, and custom usage reports—which go beyond simply “arranging” a meeting between two other parties.

The Verdict: A Victory for Exporters

The Court ruled that the services provided were a “zero-rated supply” and qualified as an export of services. The authorities were directed to process the refund claim, emphasizing that the “intermediary” classification cannot be applied loosely to companies providing services on their own account.

This judgment aligns with previous rulings from the Delhi High Court (Ernst & Young Ltd.) and the Punjab and Haryana High Court (Genpact India), which established that the scope of “intermediary” services has remained largely consistent from the pre-GST regime to the current law.

Key Takeaways for Businesses

- Contractual Clarity: Ensure service agreements explicitly state the principal-to-principal nature of the relationship.

- On Own Account: If you are providing the “main service” (e.g., software development or consultancy) using your own staff and resources, you are likely an exporter, not an intermediary.

- Refund Timelines: The Court also noted that filing a refund application on the common portal within two years satisfies the limitation period, even if physical documents are submitted later.

The Bottom Line: Being a subsidiary doesn’t automatically make you an agent. If you are delivering the service yourself, you are an exporter entitled to the benefits of zero-rated supplies.

Analogy to Solidify Understanding: Think of a restaurant delivery service versus a private chef. An intermediary is like the delivery app—they don’t cook the food; they just facilitate the transaction between you and the restaurant. Infodesk India, however, was the private chef—they were hired by the parent company to actually create the “meal” (the software and data services) themselves. Even though they worked exclusively for one client, they were providing the primary service on their own account, not just “arranging” for someone else to do it.